Table Of Content

Monetary policy is one of the most important drivers of mortgage rates. In particular, following the Great Recession, in economic downturns, the Federal Reserve has been aggressively trying to influence long-term rates in the economy through quantitative easing (QE). When you apply for a loan (or pre-approval), the lender does a hard credit check or hard inquiry. Hard inquiries can take points off your credit score, but there's a way to shop around for a mortgage without harming your credit.

Mortgage rates over 7.3% for second straight week

The average 30-year-fixed mortgage rate spiked to a five-month high of 7.4% this week, per Mortgage News Daily. The upshot is that anyone taking out a mortgage to buy a home is paying a lot more every month than in the past. Your loan program can affect your interest rate and total monthly payments. Choose from 30-year fixed, 15-year fixed, and 5-year ARM loan scenarios in the calculator to see examples of how different loan terms mean different monthly payments. The average 30-year fixed mortgage interest rate is 7.30%, which is an increase of 18 basis points from one week ago.

Insights from Economists: Detailed Predictions for Mortgage Rates in April 2024

For most people, an ARM only makes sense if you want to build your short-term savings and plan to sell or refinance the home before the adjustable-rate period kicks in. If you aren’t prepared to take on potentially higher monthly mortgage payments once your ARM rate changes, an adjustable-rate mortgage is probably not the option for you. A 30-year fixed-rate mortgage is a home loan repaid over 30 years with an interest rate that does not change. The 30-year period is your “loan term,” and usually gives you the lowest monthly payment compared to shorter terms. Home buyers can make several moves to improve their finances and qualify for competitive rates. One is having a good or excellent credit score, which ranges from 670 to 850.

Today's 15-year and 30-year mortgage rates rise April 26, 2024 - Fox Business

Today's 15-year and 30-year mortgage rates rise April 26, 2024.

Posted: Fri, 26 Apr 2024 13:15:40 GMT [source]

How To Compare Current Mortgage Rates

As 30-year fixed rates increase, ARM loans grow more popular because they often offer a lower starting rate that remains for three, five or seven years. This means you start out with lower monthly payments for a set number of years, which can help you save money. If you want the predictability that comes with a fixed rate but are looking to spend less on interest over the life of your loan, a 15-year fixed-rate mortgage might be a good fit for you. Because these terms are shorter and have lower rates than 30-year fixed-rate mortgages, you could potentially save tens of thousands of dollars in interest.

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The "principal" is the amount you borrowed and have to pay back (the loan itself), and the interest is the amount the lender charges for lending you the money. For example, you might find that a lender offers different rates for conventional loans and government-backed loans. You might qualify for the best current mortgage rate if you can make a 20% (or larger) down payment. That's because making a bigger down payment reduces your loan-to-value ratio, which lowers the risk for the lender, which in turn could qualify you for a lower rate.

How to shop for a mortgage without hurting your credit score

New home sales inch higher despite 7% mortgage rates: 'There's more opportunity,' economist says - CNBC

New home sales inch higher despite 7% mortgage rates: 'There's more opportunity,' economist says.

Posted: Fri, 26 Apr 2024 17:18:12 GMT [source]

Mortgage points represent a percentage of an underlying loan amount—one point equals 1% of the loan amount. Mortgage points are a way for the borrower to lower their interest rate on the mortgage by buying points down when they’re initially offered the mortgage. This three-page standardized document will show you the loan’s interest rate and closing costs, along with other key details such as how much the loan will cost you in the first five years. If you don’t lock in right away, a mortgage lender might give you a period of time—such as 30 days—to request a lock, or you might be able to wait until just before closing on the home. Another important consideration in this market is determining how long you plan to stay in the home. People who are buying their “forever home” have less to fear if the market reverses as they can ride the wave of ups and downs.

Mortgage terms and types

The new forecast comes as high home prices and mortgage rates have kept many Americans away from ownership. The cost of owning a home is officially the highest on record, Redfin said recently. The N.A.R. agreed to settle litigation last month that would eliminate the standard sales commission, a move housing experts say could bring down home prices. Sellers currently pay a 5 or 6 percent commission to a real estate agent, a cost that’s typically passed onto the buyer through a higher sticker price. The main disadvantage to 30-year fixed mortgage rates is mortgage interest — both in the short and long term.

Additionally, applying for multiple mortgages in a short period of time won’t show up on your credit report as it’s usually counted as one query. Borrowers should also strive for a good or excellent credit score between 670 and 850 and a debt-to-income ratio of 43% or less. Before joining Bankrate in 2020, I spent more than 20 years writing about real estate and the economy for the Palm Beach Post and the South Florida Business Journal. I’ve had a front-row seat for two housing booms and a housing bust. I’ve twice won gold awards from the National Association of Real Estate Editors, and since 2017 I’ve served on the nonprofit’s board of directors.

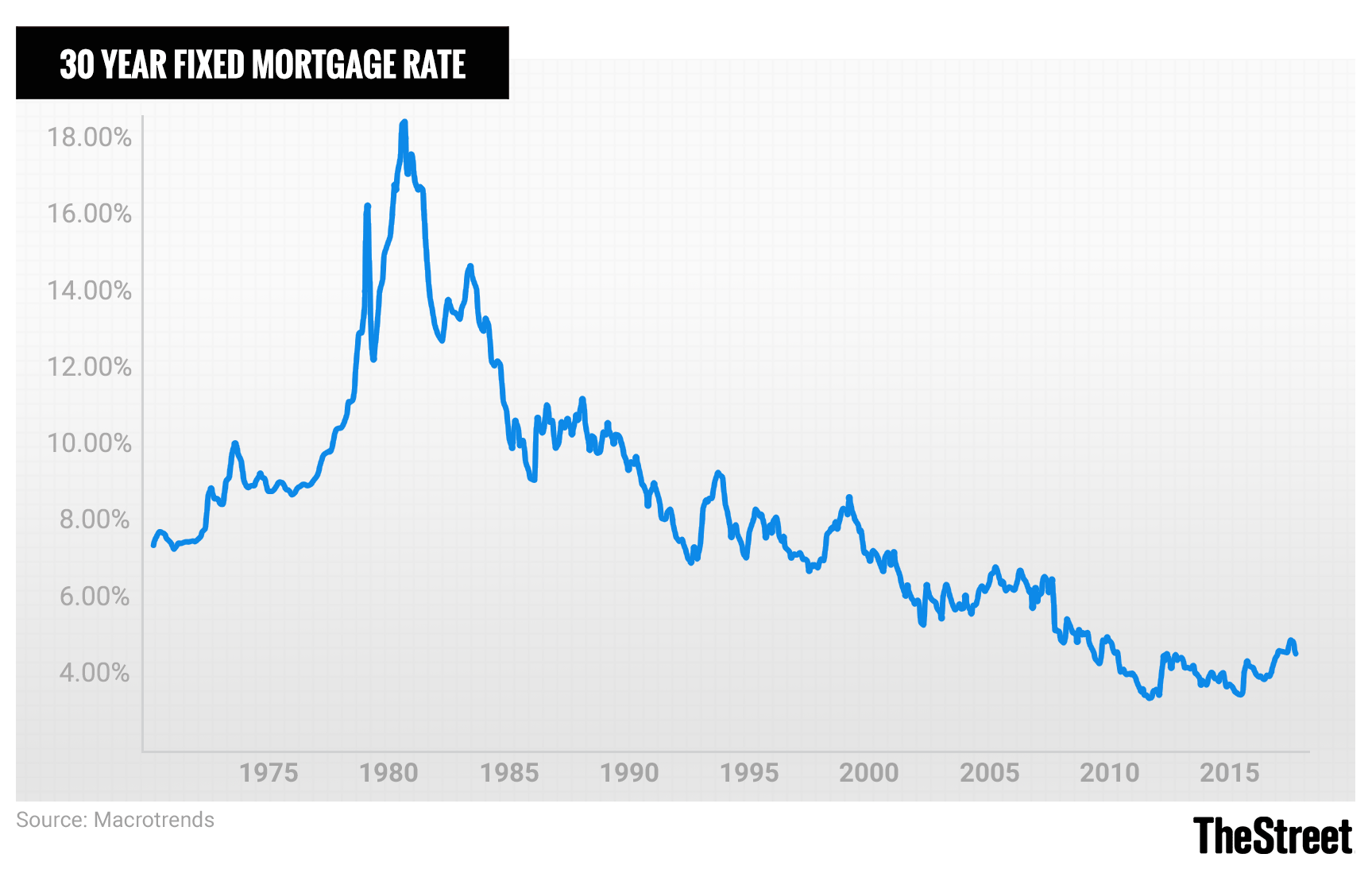

Since last summer, the Fed has consistently kept the federal funds rate at 5.25% to 5.5%. Though the central bank doesn’t directly set the rates for mortgages, a high federal funds rate makes borrowing more expensive, including for home loans. Our experts predict that, barring an unexpected increase in inflation, the Federal Reserve could make several rate cuts throughout 2024. This is good news for potential homebuyers looking to purchase in what has been the least affordable housing market since the 1980s.

Today’s homebuyers have less room in their budget to afford the cost of a home due to elevated mortgage rates and steep home prices. Limited housing inventory and low wage growth are also contributing to the affordability crisis and keeping mortgage demand down. Unlike an interest rate, however, it includes other charges or fees (such as mortgage insurance, most closing costs, points and loan origination fees) to reflect the total cost of the loan. A smaller down payment doesn't always mean you'll have to settle for a higher rate, though. The interest rates for low down payment loans (like an FHA loan or a VA loan) can be very competitive. But if you make a down payment that's less than 20%, you'll probably have to pay for private mortgage insurance until you have at least 20% equity in the home, and that will increase your monthly cost.

A mortgage loan term is the maximum length of time you have to repay the loan. Longer terms usually have higher rates but lower monthly payments. It is possible to pay down your loan faster than the set term by making additional monthly payments toward your principal loan balance.

Conversely, rates tend to decrease during periods of rate cuts and cooling inflation. The major part of your mortgage payment is the principal and the interest. The principal is the amount you borrowed, while the interest is the sum you pay the lender for borrowing it. Your lender also might collect an extra amount every month to put into escrow, money that the lender (or servicer) then typically pays directly to the local property tax collector and to your insurance carrier. C.A.R. releases its 2024 California Housing Market ForecastCalifornia housing market will rebound in 2024 as mortgage rates ebb. Mortgage rates aren't directly impacted by changes to the federal funds rate, but they often trend up or down ahead of Fed policy moves.

No comments:

Post a Comment